TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Schedule

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant

☐Check the appropriate box:

| ☐

| Preliminary Proxy Statement |

☐

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒

| Definitive Proxy Statement |

| ☐

| Definitive Additional Materials |

| ☐

| Soliciting Material Underunder §240.14a-12 |

Ranpak Holdings Corp.

(Exact Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check

the appropriate box)all boxes that apply):

☐

| Fee paid previously with preliminary materials. |

☐

| Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

TABLE OF CONTENTS

April 12, 2022

Dear Fellow Stockholders:

We

April 11, 2024

Last year, I shared with you that I believed we emerged from the challenges of 2022 better prepared to support and enhance the business moving forward. I am happy to report that we accomplished a lot in 2021 – not only in2023 and finished the year strongly. We are reaching the end of our financial results, but also in advancingreal estate and infrastructure investment cycle and are focused on optimizing our investments. Our progress with strategic PPS accounts and key initiativeswins for Ranpak’s long-term success. 2021 was aour Automation business are providing strong momentum for this year and beyond.

I want to cordially invite you to attend the 2024 Annual Meeting of

investing in our business for the long term, including big investments in our technical infrastructure, talent, and facilities. I am proudStockholders of

how we are balancing our focusRanpak Holdings Corp. at www.virtualshareholdermeeting.com/PACK2024 on

strong near-term performance, as well as investments in the business for the long term.May 23, 2024 at 10:00 a.m. Eastern time. The meeting will be held virtually, via live webcast.

I also want to share that we will soon release our

2021 ESG2023 Sustainability and Impact Report that highlights our continuing commitment to deliver a better world. We are excited for the opportunity to share our progress and demonstrate our leadership in the very important area of

ESG.Finally, I want to cordially invite you to attend the 2022 Annual Meeting of Stockholders of Ranpak Holdings Corp. at www.virtualshareholdermeeting.com/PACK2022 on May 25, 2022 at 10:00 a.m. Eastern time. The meeting will be held virtually, via live webcast.

sustainability.

The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement.

Your vote is important. Please cast your vote as soon as possible over the Internet, by telephone, or by completing and returning your proxy card in the postage-prepaid envelope so that your shares are represented. Your vote will mean that you are represented at the Annual Meeting regardless of whether or not you attend. Returning the proxy does not deprive you of your right to attend the virtual Annual Meeting and to vote your shares then. We will begin mailing the Notice of Internet Availability to our stockholders of record as of March

30, 2022 (the “Record Date”)28, 2024 for the first time on or about April

12, 2022.11, 2024.

Sincerely,

Chairman of the Board of the Directors and

Chief Executive Officer

TABLE OF CONTENTS

Ranpak Holdings Corp.

RANPAK HOLDINGS CORP. 7990

Auburn RoadAUBURN ROAD CONCORD TOWNSHIP, OH 44077

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

Notice of Annual Meeting of Stockholders to be Held on May

25, 2022 23, 2024

To the Stockholders of Ranpak Holdings Corp.:

NOTICE IS HEREBY GIVEN

that the Annual Meeting of Stockholders (the “Annual Meeting”) of Ranpak Holdings Corp., a Delaware corporation (the “Company”), will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/PACK2022 on May 25, 2022, at 10:00 a.m. Eastern time for the following purposes: | 1. | | Time and Date

May 23, 2024,

at 10:00 a.m.

(Eastern time) | | | | | | Location

virtual meeting conducted

exclusively via live webcast at www.virtualshare

holdermeeting.com/

PACK2024 | | | | | | Record Date

The foregoing items of business are

more fully described in the Proxy Statement accompanying

this Notice of Annual Meeting of Stockholders.

Only stockholders who owned common stock of the Company at the close of business on March 28, 2024 (the “Record Date”) can vote at this meeting or any adjournments that take place. | |

| | 1. | | | to elect the fourthree directors named in the Proxy Statement as Class IIIII directors of Ranpak Holdings Corp., each to serve for three years and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal; | |

| | 2. | | | to ratify the selection of Deloitte & ToucheKPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;2024; and | |

| | 3. | | | to approve a non-binding advisory resolution approving the compensation of the named executive officers; andofficers. | |

| | 4.The Company will also transact such other business as may properly come before the meeting, or any adjournment or postponement thereof. | to provide a non-binding advisory resolution on the frequency of future advisory votes on the compensation of our named executive officers. |

The Company will also transact such other business as may properly come before the meeting, or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders. Only stockholders who owned common stock of the Company at the close of business on March 30, 2022 (the “Record Date”) can vote at this meeting or any adjournments that take place.

The Board of Directors recommends that you vote:

Proposal No. 1: FOR the election of the four director nominees;

Proposal No. 2: FOR the ratification of the appointment of Deloitte & Touche LLP, as the independent registered public accounting firm;

Proposal No. 3: FOR the approval of the non-binding advisory resolution to approve the compensation of our named executive officers; and

Proposal No. 4: FOR “Every Year” as to the frequency of future advisory votes on the compensation of our named executive officers.

2022

| | Proposal No. 1: | | | FOR the election of the three director nominees; | |

| | Proposal No. 2: | | | FOR the ratification of the appointment of KPMG LLP, as the independent registered public accounting firm; and | |

| | Proposal No. 3: | | | FOR the approval of the non-binding advisory resolution to approve the compensation of our named executive officers. | |

2024 Virtual Annual Stockholder Meeting

The Board of Directors has determined to hold a virtual annual meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost. We believe this is the right choice for Ranpak currently, as it enables engagement with our stockholders, regardless of size, resources, or physical

location while safeguarding the health of our stockholders, Board and management.location. We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting

www.virtualshareholdermeeting.com/PACK2022PACK2024 at the meeting date and time.

To log in, you will need the 16-digit control number included on your proxy card or voting instruction form. The

meeting webcast will begin promptly at 10 a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 a.m., Eastern Time, and you should

TABLE OF CONTENTS

allow ample time for the check-in procedures. If you experience technical difficulties during the check-in process or during the meeting, please consult the information regarding technical assistance available at

www.virtualshareholdermeeting.com/PACK2022PACK2024 for assistance.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE VIRTUAL MEETING ONLINE, WE ENCOURAGE YOU TO READ THE ACCOMPANYING PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED

DecemberDECEMBER 31,

2021,2023, AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE USING ONE OF THE THREE CONVENIENT VOTING METHODS DESCRIBED IN “INFORMATION ABOUT THE PROXY PROCESS AND VOTING” IN THE PROXY STATEMENT. IF YOU RECEIVE MORE THAN ONE SET OF PROXY MATERIALS OR NOTICE OF INTERNET AVAILABILITY BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY SHOULD BE SIGNED AND SUBMITTED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 23, 2024. The Proxy Statement and the Company’s 2023 Annual Report on Form 10-K are available, free of charge, at proxyvote.com.

The Notice of Annual Meeting of Stockholders to be held on May

25, 2022, the accompanying Proxy Statement and the Company’s 2021 Annual Report on Form 10-K are available, free of charge, at proxyvote.com.The Notice23, 2024 contains instructions on how to access our proxy materials and vote over the internet at www.proxyvote.comand how stockholders can receive a paper copy of our proxy materials, including the accompanying Proxy Statement, a proxy card or voting instruction card and our 20212023 Annual Report on Form 10-K. Stockholders can also request to receive future proxy materials in printed form by mail or electronically by email by contacting Investor Relations Department at ir@ranpak.com, at 440-354-4445 or at 7990 Auburn Road, Concord Township, OH 44077.

By Order of the Board of Directors

Sara A. Horvath

Executive Vice President,

General CounselChief Legal Officer & Secretary

table of contents

TABLE OF CONTENTS

Page

Ranpak Holdings Corp.

RANPAK HOLDINGS CORP. 7990

Auburn RoadAUBURN ROAD CONCORD TOWNSHIP, OH 44077

PROXY STATEMENT

FOR THE 2022

For the 2024 Annual Meeting

OF STOCKHOLDERS of Stockholders May

25, 202223, 2024

We have made available our proxy materials because the Board of Directors (the

“Board”“Board”) of Ranpak Holdings Corp. (referred to herein as the

“Company,“Company,”

“Ranpak,“Ranpak,”

“we,“we,”

“us”“us” or

“our”“our”) is soliciting your proxy to vote at our

20222024 Annual Meeting of Stockholders (the

“Annual Meeting”“Annual Meeting”) to be held on May

25, 2022,23, 2024, at 10:00 a.m. Eastern time, at

www.virtualshareholdermeeting.com/PACK2022PACK2024.

| · | This Proxy Statement summarizes information about the proposals to be considered at the Annual Meeting and other information you may find useful in determining how to vote. |

| · | The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

This Proxy Statement summarizes information about the proposals to be considered at the Annual Meeting and other information you may find useful in determining how to vote.

The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

In addition to solicitations by mail, our directors, officers and employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”“SEC”), we have elected to provide access to our Annual Meeting materials, which include this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “Form 10-K”),2023, over the internet in lieu of mailing printed copies. We will begin mailing the Notice of Internet Availability to our stockholders of record as of March 30, 202228, 2024 (the “Record Date”“Record Date”) for the first time on or about April 12, 2022.11, 2024. The Notice of Internet Availability will contain instructions on how to access and review the Annual Meeting materials and will also contain instructions on how to request a printed copy of the Annual Meeting materials. Additionally, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the Annual Report on Form 10-K so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. The Annual Report on Form 10-K (and the 20222024 Proxy Statement) are available, free of charge, at proxyvote.comand are also available on our website at ir.ranpak.com.ir.ranpak.com.

Ranpak 1 2024 Proxy Statement

TABLE OF CONTENTS

The Company’s Board is

presently composed of ten members, who are divided into three classes, designated as Class I, Class II and Class III. One class of directors is elected by the stockholders at each annual meeting to serve a three-year term. Class I directors are Michael Gliedman

Steve Kovach and Alicia Tranen; Class II directors are Thomas

F. Corley, Michael

A. Jones and Robert

C. King; and Class III directors are Omar Asali,

PamelaPam El, Salil Seshadri and Kurt Zumwalt.

On April 8, 2022, Mr. Kovach notified the Company of his intention to retire from the Company’s Board, effective June 30, 2022.Class

IIIII directors standing for re-election at the Annual Meeting are

Omar Asali, Pamela El, Salil SeshadriThomas F. Corley, Michael A. Jones and

Kurt Zumwalt.Robert C. King. Class

IIII and Class

III directors will stand for election at the

20232025 and

20242026 annual meetings of stockholders, respectively.

Each of the nominees for election as Class

III directorsII director is currently a director. If elected at the Annual Meeting, each of the nominees for election as Class

III directorsII director would serve for three years and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation or removal. If any nominee is unable or unwilling to be a candidate for election, the Board may appoint another nominee or reduce the size of the Board.

Our board currently consists of ten (10) seats, with one vacancy. Proxies cannot be voted for a greater number of persons than the nominees named in this Proxy Statement.

The following table sets forth information for the nominees who are currently standing for election:

Name | Age | Director Since |

| Omar Asali | 51 | 2019 |

| Pamela El (1) | 64 | 2020 |

| Salil Seshadri (2) | 45 | 2019 |

| Kurt Zumwalt (3) | 53 | 2020 |

| | Thomas F. Corley(1) | | | 61 | | | 2019 | |

| | Michael A. Jones | | | 61 | | | 2019 | |

| | Robert C. King(2) | | | 65 | | | 2019 | |

| (1)

| Member of Nominating, Environmental, SocialSustainability & Governance Committee |

| (2) | Chair of the Compensation Committee and member of Nominating, Environmental, Social & Governance Committee |

| (3)

| Member of Audit Committee and Nominating, Environmental, Social & GovernanceCompensation Committee |

Set forth below is biographical information for the nominees. The following includes certain information regarding the nominees’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as a director. See

page 10pages 12 through 0 for the biographical information for the other directors not standing for election.

Ranpak 2 2024 Proxy Statement

Omar M. Asali, 51, has served as our Chief Executive Officer since August 2019 and Chairman of our board of directors since June 2019. He has also served as the Chairman and Chief Executive Officer of One Madison Group, a permanent capital investment vehicle, since July 2017. Mr. Asali served as President and Chief Executive Officer of HRG from 2015 until 2017, and as President of HRG since 2011. Mr. Asali also served as a director of HRG from 2011 to 2017. Mr. Asali was responsible for overseeing the day-to-day activities of HRG, including M&A activity and overall business strategy. Mr. Asali was also the Vice Chairman of Spectrum Brands and a member of the board of directors of FGL, Front Street Re Cayman Ltd. and NZCH Corporation (formerly, Zap.Com Corporation), each a subsidiary of HRG. Prior to becoming President of HRG, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital. Prior to that, Mr. Asali was the cohead of Goldman Sachs HFS where he helped manage approximately $25 billion of capital allocated to external managers. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Before joining Goldman Sachs HFS in 2003, Mr. Asali worked in Goldman Sachs’ Investment Banking Division, providing M&A and strategic advisory services to clients in the High Technology Group. Mr. Asali previously worked at Capital Guidance, a boutique private equity firm. Mr. Asali began his career working for a public accounting firm. Mr. Asali received an M.B.A. from Columbia Business School and a B.S. in Accounting from Virginia Tech. Mr. Asali also currently serves as a director at Pickle Robots, Carbone Fine Food and Virginia Tech Foundation Board.

Mr. Asali’s qualifications to serve on our board of directors include: his substantial experience in mergers and acquisitions, corporate finance and strategic business planning; his track record at HRG and in advising and managing multi-national companies; and his experience serving as a director for various public and private companies.

Pamela El, 64, has served as a director since November 2020. She is the founder of Pam El Consulting which she founded in 2019 and in which position she currently serves. Previously, from 2014 to 2018, Ms. El was EVP and

TABLE OF CONTENTS

2

Thomas F.

Corley | | | Thomas F. Corley, 61, has been a member of our Board since June 2019, and served as a member of One Madison Corporation from July 2017 until the consummation of the Business Combination. In January 2024, Mr. Corley was elected President and Chief Executive Officer of Community Coffee. He served as the Executive Vice President, Chief Global Revenue Officer for Catalina responsible for all worldwide engagements, retailer and manufacturer revenue from October 2017 to January 2020. Mr. Corley previously served as Chief Operating Officer of Acosta, Inc. from January 2016 until December 1, 2016. While at Acosta, Mr. Corley oversaw the Sales and Foodservice divisions, designed operating strategies, developed a differentiated sales organization and cultivated excellent customer relationships. Prior to serving at Acosta, Mr. Corley held several senior roles at Kraft Foods Group over a thirty-year tenure. Mr. Corley served as an Executive Vice President and President of Retail Sales and Foodservice from October 2012 through July 2015. Prior to that, Mr. Corley served as Senior Vice President of Sales from June 2009 to October 2012. His additional roles at Kraft included Vice President of Walmart/Customer Development Organization, Area Vice President, East Customer Development Organizations and Area Vice President of South Area Field Sales Organization. Mr. Corley has extensive experience with customer collaboration, new business development, field sales commercialization, acquisition integration and organizational development. Mr. Corley also serves on the Board of Directors at Carbone Sauce USA. He previously served as a Commercial Advisor to Cacique Foods, Plenty Indoor Agriculture, Revlon, Inc., Bowery Farms, Vybes Beverages and Genpact USA. Mr. Corley has also worked as an advisor to Verde Farms and Trax USA. He is also a former Board Member/Independent Director for Advantage Sales and Marketing and PRE-Brands. Mr. Corley received a B.A. in Business Administration and Management from the University of St. Thomas in Minnesota. | |

| | Mr. Corley’s qualifications to serve on our Board include his 35 years of industry experience, senior leadership roles at Kraft Foods Group, global and data services experience at Catalina and senior relationships across the CPG/Retail industry. | |

Ranpak 3 2024 Proxy Statement

CMO at the National Basketball Association, where she was responsible for global marketing for the NBA, WNBA, and NBA G League. Prior to her tenure at the NBA, from 2013 to 2014, Ms. El was SVP of Marketing for Nationwide Insurance and from 2002 to 2013, Marketing Vice President of State Farm Insurance, where she led sales and marketing strategy for the U.S. and Canada. She earned a B.S. in Mass Communications from Virginia Commonwealth University and was recently inducted into the VCU Communications Hall of Fame, and serves on the boards of Virginia Commonwealth University, Virginia Commonwealth Health System and the national board of WISE (Women in Sports & Events).

Ms. El’s qualifications to serve on our board of directors include: her extensive corporate leadership experience and marketing experience.

Salil Seshadri, 45, has been a member of our board of directors since June 2019. Mr. Seshadri is the Chief Investment Officer and founding partner of JS Capital Management LLC, a private investment firm that he started with Jonathan Soros in January 2012. JS Capital invests across public and private markets with an emphasis on owning a handful of high quality, durable, operating businesses. Prior to joining JS Capital, Mr. Seshadri was a senior member of the investment team of Soros Fund Management, where he served from 2009 to 2011, with a focus on fundamentally oriented investments. Prior to joining Soros Fund Management, Mr. Seshadri was employed for nearly a decade by Goldman Sachs Group, Inc. At Goldman Sachs, Mr. Seshadri served as Vice President in Goldman Sachs’ Hedge Fund Strategies group from 2002 to 2008. Currently, Mr. Seshadri serves as a Board member or Observer for private companies such as WheelsEye, Anello Photonics and Carbone Fine Foods. He also serves on the Investment Committee for the Ethical Culture Fieldston School in New York City. Mr. Seshadri received a B.A. in Economics, with a concentration in Psychology from Columbia University.

Mr. Seshadri’s qualifications to serve on our board of directors include: his strong business and financial acumen, including the ability to read operational financials and balance sheets; his extensive experience as an investor in public and private companies of all sizes across multiple industries; his background evaluating the financial performance of both public and private companies; and his experience as a director and/or a significant stockholder in numerous companies.

Kurt Zumwalt,53,has been a member of our board of directors since March 2020. Mr. Zumwalt served as Treasurer of Amazon.com from 2014 to August 2019, where he led global cash and portfolio management, debt financing, foreign exchange, risk management and treasury-related technology infrastructure. Prior to joining Amazon.com as assistant treasurer in 2004, he served in various financial and treasury roles at PACCAR, ProBusiness Services, Wind River Systems and Intel Corporation. While Treasurer at Amazon, Mr. Zumwalt was a member of the SEC Filing Disclosure and Enterprise Risk Management Committees as well as on the board of directors of over 100 Amazon Subsidiaries. He currently serves on the board of directors of Omeros Corporation, the United States Tennis Association (USTA) and the USTA Foundation. Mr. Zumwalt received an M.B.A. from the Foster School of Business at the University of Washington and a B.A. from the University of Pennsylvania.

Mr. Zumwalt’s qualifications to serve on our board of directors include: his strong business and financial acumen, including expertise in accounting standards and with financial statements.

THE BOARD RECOMMENDS A VOTE

FOR THE ELECTIONTABLE OF EACHCONTENTS

Michael A.

Jones | | | Michael A. Jones, 61, has been a member of our Board since June 2019, and served as a member of One Madison Corporation from July 2017 until the consummation of the Business Combination. He also served as our Vice Chairman and Managing Director, North America from September 2019 until he stepped down from these roles in November 2022. In December of 2022, Mr. Jones became President & CEO of Positec North America, while continuing to serve on our Board. Mr. Jones previously served as Chief Customer Officer of Lowe’s Companies, Inc. from May 2014 through October 2016. In this role, Mr. Jones was responsible for store environment, merchandising, customer experience, marketing, strategy and research for Lowe’s U.S. stores operations. Prior to this role, Mr. Jones served as the Chief Merchandising Officer of Lowe’s Companies Inc. since January 2013. In this capacity, Mr. Jones was responsible for both domestic and global sourcing for the merchandising offering for Lowe’s U.S. stores, and U.S. pricing operations. Mr. Jones served as Head of Business Unit Americas and Executive Vice President at Husqvarna AB from June 2011 to January 2013. In this role, Mr. Jones led sales, service and manufacturing operations for Husqvarna’s North and Latin American businesses. Prior to this role, Mr. Jones served as Head of Sales and Service for North and Latin America at Husqvarna AB since October 2009. Mr. Jones served as the General Manager of Cooking Products within the appliances division of General Electric (“GE”) from June 2007 to October 2009, and from 1994 to 2007, held various leadership positions with GE in Sales, Service, Product Management and international business. He began his career at GE in appliance builder sales and held roles with increasing responsibility during his time at GE, including Chief Commercial Officer in Europe, Middle East and Africa and for GE Consumer and Industrial. He is currently on the Board of Johnson C. Smith University, and Children’s National in Washington, DC. Mr. Jones received a B.S. in Business Administration from California Coast University in Santa Ana, California. | |

| | Mr. Jones’s qualifications to serve on our Board include: his strong business and financial acumen, including the ability to read operational financials and balance sheets; his sell-side and buy-side analyst experience including presentations to analyst and investors and business positioning; his substantial experience in strategy development and extensive leadership positions in various companies. | |

Ranpak 4 2024 Proxy Statement

TABLE OF THE ABOVE-NAMED CLASS III NOMINEES.

CONTENTS

3

Robert C.

King | | | Robert C. King, 65, has been a member of our Board since June 2019, and served as a member of One Madison Corporation from July 2017 until the consummation of the Business Combination. Mr. King served as the Chief Executive Officer of CytoSport, Inc. from June 2013 to August 2014. Prior to joining CytoSport, Mr. King served as an Advisor to TSG Consumer Partners from March 2011 to July 2013. Mr. King spent 21 years in the North America Pepsi system from 1989 to 2010. Before joining the North America Pepsi system, Mr. King worked in various sales and marketing positions with E&J Gallo Winery from 1984 to 1989 and with Procter & Gamble from 1980 to 1984. Previously, Mr. King served as an Executive Vice President and President of North America at Pepsi Bottling Group Inc. from November 2008 to 2010, with responsibility for all PBG business in the United States, Canada and Mexico. He served as the President of PBG’s North American business at Bottling Group from December 2006 to November 2008. Mr. King served as the President of North American Field Operations at Pepsi Bottling Group Inc. from October 2005 to December 2006. He served as Senior Vice President and General Manager of Pepsi Bottling Group’s Mid-Atlantic Business Unit from 2002 to 2005. Mr. King has served as a director and advisor to CytoSport, Island Oasis Frozen Cocktail Co., Inc. and Neurobrands, LLC, a producer of premium functional beverages, and Exal Corporation. Mr. King has been an Executive Advisory Partner at Wind Point Partners and Chairman of Gehl Foods, a WPP portfolio company since May 2015. Mr. King served as a Director of Freshpet Inc. and, currently, he serves as Chairman of Arctic Glacier, a Carlyle LLC portfolio company, since August 2017, and as Chairman of WernerCo, a Triton Partner portfolio company, since June 2020. Mr. King received a B.A. in English from Fairfield University. | |

| | Mr. King’s qualifications to serve on our Board include: his corporate leadership and public company experience; and his more than 44 years of substantial expertise in managing businesses and operations in the consumer packaged goods industry, including his 21 years in the North America Pepsi system. | |

| | The Board Recommends a vote FOR the election of each of the above-named Class II nominees. | |

Ranpak 5 2024 Proxy Statement

Corporate Governance

and ESG Matters

At Ranpak, sustainability is at the center of our enterprise strategy. From our beginning

nearlyover 50 years ago, our business has been built around providing our customers and end-users with effective and more sustainable alternatives to meet their secondary packaging needs. We believe that the manufacture, sale, and use of our packaging solutions directly contribute to the creation of a more sustainable – and more circular – global supply chain. We help our customers and end-users meet their own

ESGsustainability goals. At the same time, Ranpak is on its own

ESG journey as a company. In our

thirdfifth year as a public company, we

are still building our ESG analysis and reporting infrastructure. While we have made substantial progress on

ESGsustainability matters since becoming a public company – we have identified

ESGsustainability metrics that are material to our business; we collect and analyze significant

ESG-relatedsustainability-related data relating to our internal operations; we have set long-term corporate-level

ESGsustainability targets; we have assigned oversight of our

ESGsustainability performance to a committee of our Board; and, in

2022,2024, we will publish our

third ESGfifth Sustainability and Impact Report – we acknowledge that we have more to do. Moreover, we are committed to

becoming a leader in ESG reporting and performance and continuing our leadership in facilitating the emergence of a more sustainable supply chain.

Board Composition and Director Nominees

Our business and affairs are managed under the direction of our Board.

Our Board is currently composed of ten directors. The number of directors is fixed by our Board, subject to the terms of our certificate of incorporation and our bylaws.Our certificate of incorporation and our bylaws provide for a classified Board consisting of three classes of directors, each serving staggered three-year termsterms. Our current directors are as follows:

| · | Our Class I directors are Messrs. Gliedman and Kovach and Ms. Tranen, with terms expiring at the 2023 annual meeting. On April 8, 2022, Mr. Kovach notified the Company of his intention to retire from the Company’s Board, effective June 30, 2022. |

| · | Our Class II directors are Messrs. Corley, Jones and King, with terms expiring at the 2024 annual meeting. |

| · | Our Class III directors are Messrs. Asali, Seshadri and Zumwalt and Ms. El, and they are nominated for re-election at the Annual Meeting. |

Our Class I directors are Mr. Gliedman and Ms. Tranen, with terms expiring at the 2026 annual meeting.

Our Class II directors are Messrs. Corley, Jones and King, and they are nominated for re-election at the Annual Meeting.

Our Class III directors are Messrs. Asali, Seshadri, Zumwalt and Ms. El, with terms expiring at the 2025 annual meeting.

At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. Except as otherwise provided by law and subject to the rights of any class or series of preferred stock, vacancies on our Board (including a vacancy created by an increase in the size of the Board) may be filled only by the affirmative vote of a majority of the remaining directors. A director elected by the Board to fill a vacancy (other than a vacancy created by an increase in the size of the Board) serves for the unexpired term of such director’s predecessor in office and until such director’s successor is elected and qualified. A director appointed to fill a position resulting from an increase in the size of the Board serves until the next annual meeting of stockholders at which the class of directors to which such director is assigned by the Board is to be elected by stockholders and until such director’s successor is elected and qualified. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

In making recommendations to the Company’s Board of nominees to serve as directors, the Nominating, Environmental, SocialSustainability & Governance Committee will examine each director nominee on a case-by-case basis regardless of who recommended the nominee (including with respect to stockholder recommendations) and will take into account all factors it considers appropriate, including enhanced independence, financial literacy and financial expertise. In evaluating Director nominees, the Board with assistance of the Nominating, Environmental, SocialSustainability & Governance Committee, evaluates a nominee’s qualities, performance and professional responsibilities, but also the then composition of the Board and the challenges and needs of the Board at that time, including issues of judgment, diversity, (including gender or ethnic diversity), age, skills, background and experience. The Nominating, Environmental, SocialSustainability & Governance Committee does not have a specific director diversity policy, but in practice considers diversity, including age, gender identity, race, sexual orientation, physical ability, ethnicity and perspective, in evaluating candidates for Board membership.

Ranpak 6 2024 Proxy Statement

TABLE OF CONTENTS

In addition,

twothree of our

anchor investors,

JS Capital LLC, Soros Capital LLC and Schusterman Family Investments, each have the right to designate one observer to our Board.

4

There are currently three observers.Independence of the Board of Directors

Our

Six of our directors currently serving on our Board

is currently composed of ten directors, six of whom qualify as independent within the meaning of the independent director guidelines of the New York Stock Exchange (“

NYSE”NYSE”).

Consistent with our Corporate Governance Guidelines and charter of our Nominating,

Environmental, SocialSustainability & Governance Committee, our Board

of Directors has made an affirmative determination as to the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, and as a result of this review, and upon the review and recommendation of the Nominating,

Environmental, SocialSustainability & Governance Committee, our Board

of Directors has determined that each of Messrs. Corley, King, Seshadri and Zumwalt and Mses. El and Tranen are independent, as defined in the rules of the NYSE.

Board Leadership Structure

Mr. Asali serves as both our Chief Executive Officer and the Chairman of the

Board of Directors.Board. The Board

of Directors meets in executive session amongst non-management directors at each regularly scheduled quarterly Board meeting, which are presided over by

Thomas F. Corley, who serves as an independent

director.director and as Chair of the Nominating, Sustainability & Governance Committee. We also have fully independent Audit, Nominating,

Environmental, SocialSustainability & Governance, and Compensation committees along with governance practices that promote independent leadership and oversight.

The Board of Directors believes that the foregoing structure achieves an appropriate balance between the effective development of key strategic and operational objectives by the CEO and Chair, and independent oversight of management’s execution of such objectives.

The Board notes that all directors are elected by the Company’s stockholders. The Board, therefore, does not believe it appropriate or necessary in serving the best interests of the Company to designate a lead director at this time. The Board does not believe that its role in risk oversight has been affected by the Board’s leadership structure.

Ranpak 7 2024 Proxy Statement

TABLE OF CONTENTS

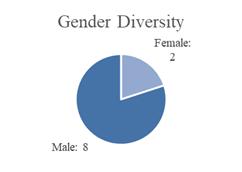

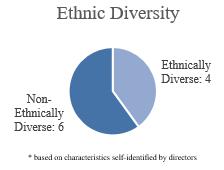

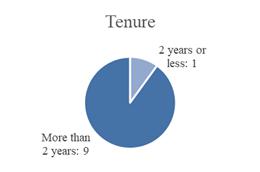

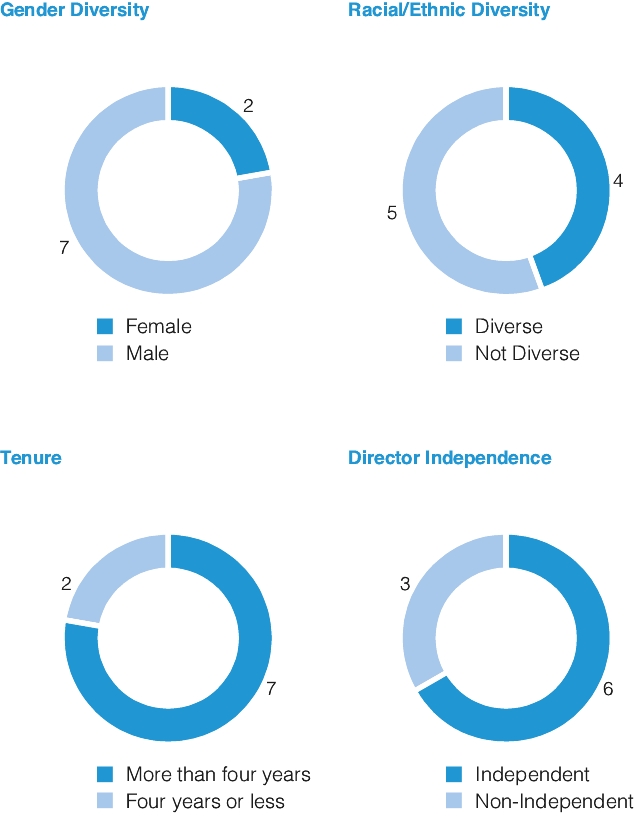

Board Diversity and Attributes

Our Board believes diversity is important and seeks representation across a range of attributes, including gender, race, ethnicity, and professional experience, and regularly assesses our Board’s diversity when identifying and evaluating director candidates. As of December 31,

2021,2023, our Board

of Directors consisted of the following:

Committees of the Board of Directors

Our Board has three fully independent standing committees: the Audit Committee, the Compensation Committee and the Nominating,

Environmental, SocialSustainability & Governance Committee. Each of the committees reports to the Board as they deem appropriate and as the Board may request.

Our Audit Committee is currently composed of Messrs. King and Zumwalt and Ms. Tranen, with Mr. King serving as the chair of the committee. Our Board has determined that each member of the Audit Committee

meetmeets the independence requirements and the financial literacy requirements under the applicable rules and regulations of the SEC and the applicable listing standards of the NYSE. Our Board has determined that

all members qualifyeach member qualifies as

an “Audit Committee financial

experts”expert” as defined under SEC rules.

Our Audit Committee oversees our corporate accounting and financial reporting process. The Audit Committee is also responsible for preparing the audit committee report that SEC rules require to be included in this Proxy Statement. The Audit Committee charter details the principal responsibilities of the Audit Committee, including assisting the Board in its oversight of:

the integrity of the Company’s financial statements and internal controls;

the qualifications, independence and performance of the Company’s independent auditor;

the design and implementation of the internal audit function; and

the Company’s compliance with legal and regulatory requirements.

Ranpak 8 2024 Proxy Statement

TABLE OF CONTENTS

| · | the integrity of the Company’s financial statements and internal controls; |

| · | the qualifications, independence and performance of the Company’s independent auditor; |

| · | the design and implementation of the internal audit function; and |

| · | the Company’s compliance with legal and regulatory requirements. |

Our Compensation Committee is composed of Messrs. Seshadri and King and Ms. Tranen, with Mr. Seshadri serving as the chair of the committee. Our Board has determined that each of Messrs. Seshadri and King and Ms. Tranen

qualifyqualifies as independent under the applicable rules of the NYSE, and each

areis a “non-employee

directors”director” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”“Exchange Act”).

The Compensation Committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The Compensation Committee charter details the principal responsibilities of the Compensation Committee, including:

| · | reviewing and approving compensation (including equity-based compensation) for the Company’s directors; |

| · | reviewing and approving the compensation of our CEO and each of the Company’s senior executive officers, including: (i) identifying, reviewing and approving corporate goals and objectives relevant to executive officer compensation; and (ii) evaluating each executive officer’s performance in light of such goals and objectives to determine such compensation; |

| · | reviewing the Company’s management succession planning in consultation with our CEO; |

| · | reviewing and evaluating the Company’s executive compensation and benefits plans generally; and |

| · | reviewing and assessing the risks arising from the Company’s employee compensation policies and practices. |

reviewing and approving compensation (including equity-based compensation) for the Company’s directors;

reviewing and approving the compensation of our CEO and each of the Company’s senior executive officers, including: (i) identifying, reviewing and approving corporate goals and objectives relevant to executive officer compensation; and (ii) evaluating each executive officer’s performance in light of such goals and objectives to determine such compensation;

reviewing the Company’s management succession planning in consultation with our CEO;

reviewing and evaluating the Company’s executive compensation and benefits plans generally; and

reviewing and assessing the risks arising from the Company’s employee compensation policies and practices.

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by the NYSE and the SEC. The Compensation Committee may delegate to one or more officers of the Company the authority to make grants and awards or options

to any non-Section 16 officer of the Company under such of the Company’s incentive-compensation or other equity-based plans as the Committee deems appropriate and in accordance with the terms of such plans.

Nominating,

Environmental, SocialSustainability & Governance Committee

Our Nominating,

Environmental, SocialSustainability & Governance Committee is currently composed of Messrs. Corley, Seshadri and Zumwalt and Ms.

El.El, with Mr. Corley serving as chair of the committee. Each of Messrs. Corley, Seshadri and Zumwalt and Ms. El is an independent director under the applicable rules of the NYSE relating to Nominating,

Environmental, SocialSustainability & Governance Committee independence.

The Nominating,

Environmental, SocialSustainability & Governance Committee is responsible for making recommendations to the Board regarding candidates for directorships and the size and composition of the Board. The Nominating,

Environmental, Social &Sustainability and Governance Committee charter details the principal responsibilities of the Nominating,

Environmental, Social &Sustainability and Governance Committee, including:

| · | reviewing and evaluating the size, composition, function and duties of the Board consistent with its needs; |

| · | recommending criteria for the selection of candidates to the Board and its committees, and identifying individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by stockholders; |

| · | recommending to the Board director nominees for election; |

| · | recommending directors for appointment to Board committees; |

| · | making recommendations to the Board as to determinations of director independence; |

| · | overseeing the evaluation of the Board; |

| · | overseeing the Company’s corporate social responsibility program, including its ESG initiatives and related risks; and |

| · | reviewing and evaluating the size, composition, function and duties of the Board consistent with its needs; recommending criteria for the selection of candidates to the Board and its committees, and identifying individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by stockholders; recommending to the Board director nominees for election; recommending directors for appointment to Board committees; making recommendations to the Board as to determinations of director independence; overseeing the evaluation of the Board; overseeing the Company’s corporate social responsibility program, including its ESG initiatives and related risks; and developing and recommending to the Board the Corporate Governance Guidelines and Code of Business Conduct and Ethics for the Company and overseeing compliance with such Guidelines and Code. |

Code of Ethics and Business Conduct for the Company and overseeing compliance with such Guidelines and Code.

Ranpak 9 2024 Proxy Statement

TABLE OF CONTENTS

Stockholder Engagement

In connection with and following our 2023 Annual Meeting, we engaged with 21 of our largest stockholders, representing approximately 65% of our outstanding shares and 71% of institutional holders. We provided updates on the Company, discussed governance, executive compensation, and other matters of interest. We discuss stockholder and advisor feedback with the Committee members as we are continuously reviewing our governance practices and executive compensation programs and will continue to welcome feedback from our stockholders.

Code of Ethics

We have adopted a Code of

Ethics and Business Conduct

and Ethics (the

“Code”“Code”) applicable to our directors, officers and employees that complies with the rules and requirements of the NYSE. The Company intends to disclose any amendments to or waivers of certain provisions of the Code

for executive officers or directors on its website at

ir.ranpak.com within the time period required by the SEC and the NYSE.

Copies of our Code, along with our Corporate Governance Guidelines and the charter of each of our Audit, Compensation and Nominating,

Environmental, SocialSustainability & Governance Committees are available on our website at

ir.ranpak.com.ir.ranpak.com. Information on or accessible through our website is not part of, or incorporated by reference into, this Proxy Statement. In addition, a copy of the Code will be provided without charge upon request.

Hedging and Pledging Policy

Our Insider Trading Policy covers hedging and pledging. Employees and directors are prohibited from engaging in any hedging transactions (including transactions involving options, puts, calls, prepaid variable forward contracts, equity swaps, collars and exchange funds or other derivatives) that are designed to hedge or speculate on any change in the market value of the Company’s equity securities. We prohibit employees and directors from pledging Company securities in any circumstance, and from holding Company securities on margin or holding Company securities in a margin account.

Our Board met

fivesix times during

2021.2023. The Audit Committee met

six20 times, the Compensation Committee met

fourfive times and the Nominating,

Environmental, SocialSustainability & Governance Committee met

twofive times. During

2021,2023, each

Board member attended at least 75% of the meetings of the Board and of the committees of the Board on which he or she served. We encourage all of our directors and nominees for director to attend our annual meeting of stockholders; however, attendance is not mandatory. NineEight out of the tennine directors then in service attended the 20212023 annual stockholders meeting.

Stockholder Communications with the Board

Should stockholders or other interested parties wish to communicate with the Board, non-management or independent directors as a group or any specified individual directors, such correspondence should be sent to the attention of Sara Horvath, Secretary at Ranpak, 7990 Auburn Road, Concord Township, Ohio 44077. The Secretary will forward correspondence relating to the Board’s duties or responsibilities to the specified recipient. Correspondence that is unrelated to a director’s duties will be handled at the Secretary’s discretion. Stockholders may also submit recommendations of director candidates by following the same procedures.

Role of the Board in Risk Oversight

The Board oversees our risk management. The Board,

of Directors, directly and through

audit committeesthe Audit and other Committees carries out this oversight role by reviewing the Company’s policies and practices with respect to risk assessment and risk management, and by discussing with management the risks inherent in the operation of our business.

ESG

To highlight our commitment to ESGSustainability practices, we publish an annual ESGSustainability and Impact Report. For more information, and a copy of our most recent ESGSustainability and Impact Report, please visit our website at ranpak.com/sustainability.sustainability.

Ranpak 10 2024 Proxy Statement

TABLE OF CONTENTS

Board Oversight of Material Environmental and Social Risk

Ranpak takes into account considerations that affect

all of our key stakeholders, including our stockholders, customers, employees, communities, regulators and suppliers. In recognition of this,

in March 2021, the Company affirmatively expanded the purpose and responsibilities of the thenour Nominating,

and CorporateSustainability & Governance Committee of the Board

to oversee, reviewoversees, reviews and

assessassesses Ranpak’s

sustainability and corporate social responsibility program and

ESG initiatives and accordingly, changed the name of such Committee to the Nominating, Environmental, Social & Governance Committee.initiatives. The Nominating,

Environmental, SocialSustainability & Governance Committee reviews our

ESG reporting, including our annual

ESGSustainability and Impact Report, and

receivedreceives regular briefings from our Chief Sustainability Officer. The committee

continues to reportreports to our full Board which has ultimate responsibility to oversee material

ESG risks and opportunities.

Human Capital Resources and Workforce Diversity

We are a global organization that values life experiences, ideas, and cultures that each of our employees bring to Ranpak, striving to create an atmosphere of acceptance and respect, facilitating an encouraging environment, and helping employees attain professional and educational goals. We are proud to count men and women of all races and ethnicities as members of our Board,

of Directors, management team, and employee workforce.

In 2020, we joinedWe are a Charter Pledge Partner in The Board Challenge,

as a Charter Pledge Partner. The Board Challengewhich is an initiative to improve diverse representation in corporate U.S. boardrooms. As a Charter Pledge Partner, we acknowledge that we already have diversity in our boardroom and pledge to use our resources to accelerate change within other companies. We utilize interview guides in our hiring processes to help identify different competencies, such as diversity, equity, and inclusion competencies, to ensure that new hires are developed in these areas. Additionally, we developed robust anti-bias training to ensure that every potential candidate is given a fair and merit-based evaluation of their skills.

We strive to maintain an active dialogue with our employees and provide employees a comprehensive benefits package including competitive wages, medical, life, and accident insurance, incentive bonus programs, and a 401(k) plan with an employer matching contribution. We have departmental budgets set aside for training and also provide a tuition reimbursement program for employees seeking

bachelorsbachelor's or

mastersmaster's degrees. Certain employees are also eligible for stock-based compensation programs that are designed to encourage long-term performance aligned with Company objectives. In June 2019 and September 2021, every employee (excluding those eligible for stock-based compensation programs) received an equity award, providing a community of employee-owners who can personally share in the reward of our collective success.

Note About Website and ESGSustainability and Impact Reports

The reports mentioned above, or any other information from our website, are not part of, or incorporated by reference into this Proxy Statement. Some of the statements and reports contain cautionary statements regarding forward-looking information that should be carefully considered. Our statements and reports about our objectives may include statistics or metrics that are estimates, make assumptions based on developing standards that may change, and provide aspirational goals that are not intended to be promises or guarantees. The statements and reports may also change at any time and we undertake no obligation to update them, except as required by law.

Web links to our website throughout this document are provided for convenience only. Please note that information on or accessible through our website is not part of, or incorporated by reference into, this Proxy Statement.

Ranpak 11 2024 Proxy Statement

TABLE OF CONTENTS

The following table sets forth the name, age as of April

12, 2022,11, 2024, and position of the nominees for election at the Annual Meeting and the other current directors of Ranpak Holdings Corp. whose terms extend past the Annual Meeting. The following also includes certain information regarding our directors’ individual experience, qualifications, attributes and skills and brief statements of those aspects of our directors’ backgrounds that led us to conclude that they are qualified to serve as directors (information for Messrs.

Asali, Seshadri, ZumaltCorley, Jones and

Ms. ElKing is set forth above in “Proposal No. 1 Election of Directors”).

Name | Age | Director Since | Position | Independent |

| Omar M. Asali | 51 | 2019 | Chairman and Chief Executive Officer | |

| Michael A. Jones | 59 | 2019 | Vice Chairman and Managing Director, North America | |

| Thomas F. Corley(3) | 59 | 2019 | Director | ü |

| Pamela El(3) | 64 | 2020 | Director | ü |

| Robert C. King(1)(2) | 63 | 2019 | Director | ü |

| Steve A. Kovach | 64 | 2019 | Director | |

| Salil Seshadri(2)(3) | 45 | 2019 | Director | ü |

| Michael S. Gliedman | 58 | 2020 | Director and Chief Technology Officer | |

| Alicia M. Tranen(1)(2) | 49 | 2019 | Director | ü |

| Kurt Zumwalt (1) (3) | 53 | 2020 | Director | ü |

| | Omar Asali | | | 53 | | | 2019 | | | Chairman and Chief Executive Officer | | | | |

| | Thomas F. Corley(1) | | | 61 | | | 2019 | | | Director | | | | |

| | Pam El(1) | | | 66 | | | 2020 | | | Director | | | | |

| | Michael S. Gliedman | | | 60 | | | 2019 | | | Director and Chief Technology Officer | | | | |

| | Michael A. Jones | | | 61 | | | 2019 | | | Director | | | | |

| | Robert C. King(2)(3) | | | 65 | | | 2019 | | | Director | | | | |

| | Salil Seshadri(1)(3) | | | 47 | | | 2019 | | | Director | | | | |

| | Alicia Tranen(2)(3) | | | 51 | | | 2019 | | | Director | | | | |

| | Kurt Zumwalt(1)(2) | | | 55 | | | 2020 | | | Director | | | | |

(1)

| (1)Member of the Nominating, Sustainability & Governance Committee |

(2)

| Member of the Audit Committee |

| (2)(3)

| Member of the Compensation Committee |

Ranpak 12 2024 Proxy Statement

TABLE OF CONTENTS

Omar

Asali | (3) | Member | Omar Asali, 53, has served as our Chief Executive Officer and Chairman of the Nominating, Environmental, SocialBoard since June 2019, and served as Chief Executive Officer and Chairman of the Board of the special purpose acquisition corporation launched by One Madison Group, One Madison Corporation (OMAD) from September 2017 until the consummation of the Business Combination. Mr. Asali founded One Madison Group, LLC in 2019 and, since 2024, he has been a Co-Founder and Partner of reconstituted One Madison Group. Mr. Asali served previously as President and Chief Executive Officer of HRG. Mr. Asali also served as a director of HRG from 2011 to 2017. Mr. Asali was responsible for overseeing the day-to-day activities of HRG, including M&A activity and overall business strategy. Mr. Asali was also the Vice Chairman of Spectrum Brands and a member of the board of directors of FGL and Front Street Re Cayman Ltd., each a subsidiary of HRG. Prior to becoming President of HRG, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital. Prior to that, Mr. Asali was the cohead of Goldman Sachs Hedge Fund Strategies where he helped manage approximately $25 billion of capital. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Before joining Goldman Sachs HFS in 2003, Mr. Asali worked in Goldman Sachs’ Investment Banking Division. Mr. Asali received an M.B.A. from Columbia Business School and a B.S. in Accounting from Virginia Tech. Mr. Asali also currently serves as a director at Plenty Unlimited, Pickle Robot, Carbone Fine Food and Virginia Tech Foundation Board. | |

| | Mr. Asali’s qualifications to serve on our Board include: his substantial experience in mergers and acquisitions, corporate finance and strategic business planning; his track record at HRG and in advising and managing multi-national companies; and his experience serving as a director for various public and private companies. | |

Pam

El | | | Pam El, 66, has served as a director since November 2020. She founded Pam El Consulting in 2019, and currently serves as its CEO. Previously, from 2014 to 2018, Ms. El was EVP and CMO at the National Basketball Association, where she was responsible for global marketing for the NBA, WNBA, and NBA G League. Prior to her tenure at the NBA, from 2013 to 2014, Ms. El was SVP of Marketing for Nationwide Insurance and from 2002 to 2013, Marketing Vice President of State Farm Insurance, where she led sales and marketing strategy for the U.S. and Canada. She earned a B.S. in Mass Communications from Virginia Commonwealth University and was recently inducted into the VCU Communications Hall of Fame. She also serves as a director on the board of IDIQ, an industry leader in credit report and identity theft monitoring and data breach preparation. Ms. El also serves on the national board of the non-profit WISE (Women in Sports & Governance CommitteeEvents). | |

| | Ms. El’s qualifications to serve on our Board include: her extensive corporate leadership experience and marketing experience. | |

Ranpak 13 2024 Proxy Statement

Michael A. Jones, 59, has been a member of our board of directors since July 2017 and has served as our Vice Chairman and Managing Director, North America since September 2019. Mr. Jones served as Chief Customer Officer of Lowe’s Companies, Inc. from May 2014 through October 2016. In this role, Mr. Jones was responsible for store environment, merchandising, customer experience, marketing, strategy and research for Lowe’s U.S. stores operations. Prior to this role, Mr. Jones served as the Chief Merchandising Officer of Lowe’s Companies Inc. since January 2013. In this capacity, Mr. Jones was responsible for both domestic and global sourcing for the merchandising offering for Lowe’s U.S. stores, and U.S. pricing operations. Mr. Jones served as Head of Business Unit Americas and Executive Vice President at Husqvarna AB from June 2011 to January 2013. In this role, Jones led sales, service and manufacturing operations for Husqvarna’s North and Latin American businesses. Prior to this role, Mr. Jones served as Head of Sales and Service for North and Latin America at Husqvarna AB since October 2009. Mr. Jones served as the General Manager of Cooking Products within the appliances division of General Electric (“GE”) from June 2007 to October 2009, and from 1994 to 2007, held various leadership positions with GE in Sales, Service, Product Management and international business. He began his career at GE in appliance builder sales, and held roles with increasing responsibility during his time at GE, including Chief Commercial Officer in Europe, Middle East and Africa and for GE Consumer and Industrial. He is currently on the Board of Johnson C. Smith University, and Children’s National in Washington, DC. Mr. Jones received a B.S. in Business Administration from California Coast University in Santa Ana, California.

Mr. Jones’s qualifications to serve on our board of directors include: his strong business and financial acumen, including the ability to read operational financials and balance sheets; his sell-side and buy-side analyst experience including presentations to analyst and investors and business positioning; his substantial experience in strategy development and extensive leadership positions in various companies.

Thomas F. Corley, 59, has been a member of our board of directors since July 2017. Mr. Corley served as the Executive Vice President, Chief Global Revenue Officer for Catalina responsible for all worldwide engagements, retailer and manufacturer revenue from October 2017 to January 2020. Mr. Corley previously served as Chief Operating Officer of Acosta, Inc. from January 2016 until December 1, 2016. While at Acosta, Mr. Corley oversaw the Sales and Foodservice divisions, designed operating strategies, developed a differentiated sales organization and cultivated excellent customer relationships. Prior to serving at Acosta, Mr. Corley held several senior roles at Kraft

TABLE OF CONTENTS

10

Michael S.

Gliedman | | | Michael S. Gliedman, 60, has served as our Chief Technology Officer since March 2020. In this capacity, Mr. Gliedman oversees all aspects of technology for the Company as well as Digital and Corporate Marketing. He has been a member of our Board since June 2019. Mr. Gliedman is also Managing Director of Blue Strat Advisors, a technology strategy and digital transformation consulting firm that he founded in November 2017. Previously, Mr. Gliedman was Senior Vice President and Chief Information Officer for the National Basketball Association from July 1999 to July 2017, where he was responsible for identifying and applying technologies to enhance the fan experience, technology strategy formulation, systems design and implementation and cybersecurity for the league. Prior to joining the NBA, Mr. Gliedman served as Senior Vice President, Application Development at Viacom from May 1997 to June 1999. Prior to joining Viacom, he was a Principal in the Media & Entertainment practice at Booz Allen & Hamilton, from October 1991 to May 1997. Mr. Gliedman received an M.B.A. with a concentration in Marketing from Columbia Business School and a B.A. in Computer Science from Brandeis University. | |

| | Mr. Gliedman’s qualifications to serve on our Board include: his extensive experience driving business focused technology initiatives developed through years as a management consultant and as an operator at both Viacom and the NBA; his substantial expertise in digital marketing and social media; and his 18 years of corporate leadership experience as a senior executive at the NBA. | |

Salil

Seshadri | | | Salil Seshadri, 47, has been a member of our Board since June 2019. Mr. Seshadri is a Co-Founder and Partner of One Madison Group, LLC, a registered investment advisor that invests across public and private markets with a focus on long-term value creation. Prior to co-founding One Madison, Mr. Seshadri was the Chief Investment Officer and founding partner of JS Capital Management LLC, a private investment firm, where he served from 2011 to 2023. JS Capital invests across public and private markets with an emphasis on owning a handful of high quality, durable, operating businesses. Prior to joining JS Capital, Mr. Seshadri was a senior member of the investment team at Soros Fund Management, where he served from 2009 to 2011. Prior to joining Soros Fund Management, Mr. Seshadri was employed for nearly a decade by Goldman Sachs Group, Inc. At Goldman Sachs, Mr. Seshadri served as Vice President in Goldman Sachs’ Hedge Fund Strategies group from 2002 to 2008. Currently, Mr. Seshadri serves as a Board member or Observer for private companies such as WheelsEye, Plenty, Pickle Robot, MUSIC, Anello Photonics and Carbone Fine Foods. Mr. Seshadri received a B.A. in Economics, with a concentration in Psychology from Columbia University. | |

| | Mr. Seshadri’s qualifications to serve on our board of directors include: his strong business and financial acumen, including the ability to read operational financials and balance sheets; his extensive experience as an investor in public and private companies of all sizes across multiple industries; his background evaluating the financial performance of both public and private companies; and his experience as a director and/or a significant stockholder in numerous companies. | |

Foods Group over a thirty year tenure. Mr. Corley served as an Executive Vice President and President of Retail Sales and Foodservice from October 2012 through July 2015. Prior to that, Mr. Corley served as Senior Vice President of Sales from June 2009 to October 2012. His additional roles at Kraft included Vice President of Walmart/Customer Development Organization, Area Vice President, East Customer Development Organizations and Area Vice President of South Area Field Sales Organization. Mr. Corley has extensive experience with customer collaboration, new business development, field sales commercialization, acquisition integration and organizational development. Mr. Corley also serves on the Board of Directors at PRE-Brands, Carbone Retail Sauce and Whitehouse Foods. He is also a Director at One Madison Group, on the Retail Advisory Board of TRAX USA and a Commercial Advisor for Bowery Farms. He is also a former Board Member/Independent Director for Advantage Sales and Marketing. Mr. Corley received a B.A. in Business Administration and Management from the University of St. Thomas in Minnesota.

Mr. Corley’s qualifications to serve on our board of directors include his 35 years of industry experience, senior leadership roles at Kraft Foods Group, global and data services experience at Catalina and senior relationships across the CPG/Retail industry.

Robert C. King, 63, has been a member of our board of directors since July 2017. Mr. King served as the Chief Executive Officer of CytoSport, Inc. from June 2013 to August 2014. Prior to joining CytoSport, Mr. King served as an Advisor to TSG Consumer Partners from March 2011 to July 2013. Mr. King spent 21 years in the North America Pepsi system from 1989 to 2010. Before joining the North America Pepsi system, Mr. King worked in various sales and marketing positions with E&J Gallo Winery from 1984 to 1989 and with Procter & Gamble from 1980 to 1984. Previously, Mr. King served as an Executive Vice President and President of North America at Pepsi Bottling Group Inc. from November 2008 to 2010, with responsibility for all PBG business in the United States, Canada and Mexico. He served as the President of PBG’s North American business at Bottling Group from December 2006 to November 2008. Mr. King served as the President of North American Field Operations at Pepsi Bottling Group Inc. from October 2005 to December 2006. He served as Senior Vice President and General Manager of Pepsi Bottling Group’s Mid-Atlantic Business Unit from 2002 to 2005. Mr. King has served as a Director and advisor to CytoSport, Island Oasis Frozen Cocktail Co., Inc. and Neurobrands, LLC, a producer of premium functional beverages, and Exal Corporation. Mr. King has been an Executive Advisory Partner at Wind Point Partners and Chairman of Gehl Foods, a WPP portfolio company since May 2015. Mr. King served as a Director of Freshpet Inc. and, currently, he serves as Chairman of Arctic Glacier, a Carlyle LLC portfolio company, since August 2017, and as Chairman of WernerCo, a Triton Partner portfolio company, since June 2020. Mr. King received a B.A. in English from Fairfield University.

Mr. King’s qualifications to serve on our board of directors include: his corporate leadership and public company experience; and his more than 41 years of substantial expertise in managing businesses and operations in the consumer packaged goods industry, including his 21 years in the North America Pepsi system.

Steve A. Kovach, 64, has been a member of our board of directors since June 2019. Mr. Kovach is currently retired. He served as the President and Chief Executive Officer of

Ranpak Corp. from August 2012 to June 2017. In this role, Mr. Kovach was responsible for overseeing the day-to-day activities14 2024 Proxy Statement

TABLE OF CONTENTS

Alicia

Tranen | | | Alicia Tranen, 51, has been a member of our Board since June 2019. Ms. Tranen is currently the Founder, General Partner and Portfolio Manager of Boulevard Capital Management, which she founded in June 2008. Boulevard Capital Management is an investment fund that primarily invests in public companies. Ms. Tranen is also a Senior Advisor to 3L Capital Management, a growth equity firm based in New York City and Los Angeles. Previously, she served as a Senior Analyst at Cantillon Capital, an $11 billion long-short equity hedge fund, from inception in February 2003 to March 2008. At Cantillon, Ms. Tranen was a senior member of the investment team. Prior to that, she was a Principal at RRE Ventures, a venture capital firm with $500 million in assets, from September 1999 to March 2002. While at RRE Ventures, Ms. Tranen served on the boards of directors, or as an observer to the board, of 10 RRE Ventures portfolio companies. From September 1994 to August 1997, Ms. Tranen was a Research Associate at Fidelity Management & Research Co, where she was responsible for research, analysis and coverage of over 100 public companies. Ms. Tranen currently serves on the National Board of Team Impact. Ms. Tranen received an M.B.A. from Harvard Business School and a B.A. in Economics from Tufts University. | |

| | Ms. Tranen’s qualifications to serve on our Board include: her strong business and financial acumen, including the knowledge of operational financials and balance sheets; her extensive experience as an investor in public companies of all sizes across multiple industries; her background evaluating the financial performance of late stage private companies and public companies; and her experience as a director and/or a significant stockholder in numerous companies. | |

Kurt

Zumwalt | | | Kurt Zumwalt, 55, has been a member of our Board since March 2020. Mr. Zumwalt served as Treasurer of Amazon from 2014 to August 2019, where he led global cash and portfolio management, debt financing, foreign exchange, risk management and treasury-related technology infrastructure. Prior to joining Amazon as assistant treasurer in 2004, he served in various financial and treasury roles at PACCAR, ProBusiness Services, Wind River Systems, and Intel Corporation. While Treasurer at Amazon, Mr. Zumwalt was a member of the SEC Filing Disclosure and Enterprise Risk Management Committees as well as on the board of directors of over 100 Amazon subsidiaries. He has previously served on the board of the United States Tennis Association (USTA) and the USTA Foundation from 2019 through 2022, as well as the board of Omeros (OMER) from March 2020 through June 2023. He also currently serves on the board of the Women’s Tennis Association (WTA) since August of 2023. Mr. Zumwalt received an M.B.A. from the Foster School of Business at the University of Washington and a B.A. from the University of Pennsylvania. | |

| | Mr. Zumwalt’s qualifications to serve on our Board include: his strong business and financial acumen, including expertise in accounting standards and with financial statements. | |

Ranpak and overall corporate strategy. Prior to that, he was a Senior Vice President and the Chief Financial Officer of Ranpak Corp. from September 1996 to July 2012 and was responsible for all financial reporting and managing Ranpak’s financial management personnel and systems, as well as the company’s human resource and information technology functions. He also served as a Director of Ranpak from April 2002 to June 2017. From July 1988 until July 1993, Mr. Kovach was employed by LDI Corporation in a variety of managerial positions including serving as Vice President, Finance. He was also a Manager, Financial Trading and held other professional positions at BP America from July 1984 to July 1988. Mr. Kovach received an M.B.A. from the University of Chicago and a B.S.B.A. in Finance from Miami University, Ohio.15 2024 Proxy Statement

Mr. Kovach’s qualifications to serve on our board of directors include: his corporate leadership experience, including his experience as the Chief Executive Officer and, prior to that, as the Chief Financial Officer of Ranpak; his substantial expertise in managing businesses, operations and business strategy in the protective packaging industry, including his 21 years as a senior executive at Ranpak; and his extensive experience in corporate finance.

On April 8, 2022, Mr. Kovach notified the Company of his intention to retire from the Company’s Board, effective June 30, 2022.

Michael S. Gliedman, 58, has served as our Chief Technology Officer since March 2020. In this capacity, Mr. Gliedman oversees all aspects of technology for the Company as well as Digital and Corporate Marketing. He has been a member of our board of directors since June 2019. Mr. Gliedman is also Managing Director of Blue Strat

TABLE OF CONTENTS

Advisors, a technology strategy and digital transformation consulting firm that he founded in November 2017. Previously, Mr. Gliedman was Senior Vice President and Chief Information Officer for the National Basketball Association from July 1999 to July 2017, where he was responsible for identifying and applying technologies to enhance the fan experience, technology strategy formulation, systems design and implementation and cyber-security for the league. Prior to joining the NBA, Mr. Gliedman served as Senior Vice President, Application Development at Viacom from May 1997 to June 1999. Prior to joining Viacom, he was a Principal in the Media & Entertainment practice at Booz Allen & Hamilton, from October 1991 to May 1997. Mr. Gliedman received an M.B.A. with a concentration in Marketing from Columbia Business School and a B.A. in Computer Science from Brandeis University.

Mr. Gliedman’s qualifications to serve on our board of directors include: his extensive experience driving business focused technology initiatives developed through years as a management consultant and as an operator at both Viacom and the NBA; his substantial expertise in digital marketing and social media; and his 18 years of corporate leadership experience as a senior executive at the NBA.